8.00 - 9.00

Opening Hour Mon - Fri

You can now register a security right over your movable property online using your e-Citizen account! The Movable Property Security Rights Act, 2017 (MPSRA), which became law in May 2017, makes this possible. The Act was introduced to make it easier for individuals and businesses to access credit by allowing them to use movable property as collateral.

The MPSRA replaced the old Chattels Transfer Act and also made changes to several other laws, including:

The law is implemented through the Movable Property Security Rights (General) Regulations, 2017.

The Act was created to:

A Security Right is a legal claim over a movable asset that is used to secure the payment of a loan or the performance of an obligation. This means that if the borrower (grantor) fails to pay, the lender (secured creditor) can take possession of the asset or sell it to recover the loan amount.

A Security Right is created through a written agreement between:

To be valid, the grantor must have ownership rights over the asset or the legal power to use it as collateral.

A security agreement can also cover future assets (property that the borrower does not own yet). However, the security right only takes effect when the borrower actually acquires the asset.

For the agreement to be legally valid, it must:

The Movable Property Security Rights Registry is an online system that allows lenders (secured creditors) to:

Once the borrower (grantor) and lender (secured creditor) have signed their security agreement, they must register a notice in the registry.

Good news! Registration is currently free.

Once a security notice is registered, you can search the registry to check if a particular movable asset has an existing security right.

After a security right has been registered, the lender (secured creditor) can either:

A registered security notice can be canceled if:

Read more blog posts here! https://wjmaxwell.co.ke/blog/0/0

Disclaimer: This is not legal advice and should not be relied upon as such.

Contact us for further details.

Email info@wjmaxwell.co.ke || or call/text/WhatsApp 0733 61 09 61

W.J. Maxwell & Associates Advocates

Leaders in Law: Reshaping the Practice of Law

Introduction

For years, shylocks and microfinance institutions (MFIs) in Kenya have played a crucial role in providing credit to individuals and businesses that lack access to mainstream financial institutions. However, their lending practices have often been constrained by cumbersome collateral requirements, legal uncertainties, and the risk of default.

The introduction of the Movable Property Security Rights Act, 2017 (MPSR Act) has significantly transformed the lending landscape, making it easier for small lenders to secure their interests in movable assets without the burden of court processes. This article explores how the MPSR framework benefits shylocks and MFIs, comparing it with the pre-existing regulations and highlighting its key advantages.

Understanding the Movable Property Security Rights Act, 2017

The MPSR Act was enacted to create a clear legal framework for using movable assets as collateral. Before its enactment, lenders faced challenges in securing their loans, especially in cases where borrowers defaulted. The traditional laws did not provide an efficient system for recognizing, registering, and enforcing security interests in movable property.

Under the MPSR framework, lenders can now register their security interests in a centralized registry, which provides legal recognition of their rights and simplifies the process of recovering debts in case of default.

How the MPSR Act Benefits Shylocks and Microfinance Institutions

1. Expanding the Scope of Acceptable Collateral

Traditionally, most lenders, including banks, required immovable property such as land or buildings as collateral. However, many small borrowers, particularly those seeking loans from shylocks and MFIs, do not own such assets.

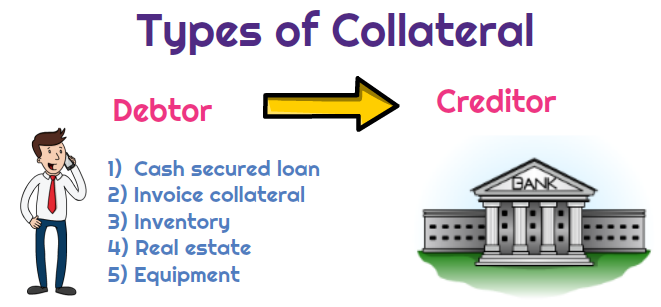

The MPSR Act allows lenders to take security over a wide range of movable assets, including:

Motor vehicles

Stock-in-trade

Household goods

Livestock

Intellectual property (such as patents and copyrights)

Accounts receivable

This expansion of acceptable collateral enables shylocks and MFIs to lend more confidently, even to individuals who lack land titles or real estate holdings.

2. Centralized Online Registration System

The Movable Property Security Rights Registry provides an online system where lenders can register their security interests. This registration serves as public notice that a specific movable asset is encumbered, reducing the risk of fraud and double pledging of assets.

For shylocks and MFIs, this means they can easily verify whether an asset has been used as collateral for another loan before accepting it as security. This transparency was previously lacking, making it difficult for lenders to assess the risk of lending against movable property.

3. No Need to Go to Court for Debt Recovery

One of the most significant advantages of the MPSR framework is that it eliminates the need for expensive and time-consuming court processes when enforcing security interests.

Previously, if a borrower defaulted on a loan secured by movable property, the lender often had to seek court intervention to repossess or sell the asset. This was particularly difficult for shylocks and MFIs, who lacked the resources for prolonged legal battles.

Under the MPSR Act, lenders can enforce their security interests without going to court by:

Seizing and selling the collateral after notifying the borrower

Appointing a receiver to take control of the asset

Retaining the collateral in satisfaction of the debt

These provisions ensure that lenders can recover their money more efficiently, reducing losses associated with loan defaults.

4. Better Legal Protection for Lenders

Before the MPSR Act, shylocks and MFIs operated in a largely informal manner, exposing them to legal risks. Many borrowers would dispute loan agreements, claiming unfair lending terms or denying the existence of a loan altogether.

With the MPSR framework, a registered security interest provides legal proof of the lender’s claim over the collateral. This protects lenders from fraudulent borrowers who might attempt to dispose of the asset or claim that they never took the loan.

5. Higher Loan Recovery Rates

By reducing legal uncertainties and simplifying enforcement procedures, the MPSR Act increases the likelihood of recovering loans. When borrowers know that lenders can quickly seize and sell collateral without court intervention, they are more likely to honor their loan obligations.

Additionally, lenders can now conduct better risk assessments using the movable assets registry, ensuring that they only accept collateral that is free of existing encumbrances.

6. Lower Lending Costs and Improved Profitability

For many shylocks and MFIs, legal fees and court-related costs were a significant burden. The MPSR Act reduces these expenses, allowing lenders to operate more efficiently.

By streamlining the lending process, reducing default risks, and improving loan recovery rates, the new framework enhances profitability for lenders while ensuring fairer lending practices.

Comparison with Pre-existing Regulations

Before the enactment of the MPSR Act, lenders relied on outdated legal frameworks such as the Chattels Transfer Act and common law principles. These regulations had several limitations:

The MPSR Act has effectively modernized the process, making lending against movable assets safer, faster, and more cost-effective.

Conclusion

The Movable Property Security Rights Act, 2017 is a game-changer for shylocks and microfinance institutions in Kenya. By expanding the scope of acceptable collateral, introducing a centralized registration system, and eliminating the need for court intervention, the Act provides a more efficient and legally secure lending framework.

For lenders, this means higher loan recovery rates, reduced legal costs, and greater confidence in issuing credit to small borrowers. By leveraging the benefits of the MPSR Act, shylocks and MFIs can expand their businesses while mitigating risks, ultimately contributing to increased financial inclusion in Kenya.

Shylocks and microfinance institutions should actively embrace the MPSR system by registering their security interests and familiarizing themselves with the enforcement procedures. By doing so, they will not only protect their investments but also enhance their competitiveness in the evolving financial landscape.

Read more blog posts here! https://wjmaxwell.co.ke/blog/0/0

Disclaimer: This is not legal advice and should not be relied upon as such.

Contact us for further details.

Email info@wjmaxwell.co.ke || or call/text/WhatsApp 0733 61 09 61

W.J. Maxwell & Associates Advocates

Leaders in Law: Reshaping the Practice of Law

Read more blog posts here! https://wjmaxwell.co.ke/blog/0/0

Disclaimer: This is not legal advice and should not be relied upon as such.

Contact us for further details.

Email info@wjmaxwell.co.ke || or call/text/WhatsApp 0733 61 09 61

W.J. Maxwell & Associates Advocates

Leaders in Law: Reshaping the Practice of Law

When it comes to determining child custody, the law prioritizes parental care as the primary basis for awarding custody in the event of a dispute. It acknowledges that a child has an inherent right to live with their parents. However, if a court determines that such a living arrangement is not in the child's best interest, it may order a separation.

In such cases, the court ensures that the child receives the best possible alternative care, with a preference for family-based options. This may include placement with the mother, father, older siblings, or other relatives.

If a court orders the separation of siblings from their mother, it mandates that the siblings be placed together under care and protection, unless compelling reasons justify their separation.

Children who are separated from one or both parents have the right to maintain regular personal contact and relationships with the parent(s) they are separated from, unless the court deems such contact to be contrary to the child's best interests.

Right to Social Security

In instances where parents are unable to support their child, the child is entitled to social security as guaranteed by Article 43(3) of the Constitution. This Article provides that “the State shall provide appropriate social security to persons who are unable to support themselves and their dependents”. This provision ensures that the government provides appropriate social security for individuals who cannot support themselves and their dependents.

"Social security" in regards to Children Matters includes alternative care services, and in particular— adoption, foster care, kinship care, institutional care, guardianship, supported independent living, supported child-headed households, kafaalah, aftercare, among others.

Objectives of Alternative Care

The primary objectives of alternative care are to:

It is crucial to note that factors such as poverty, disability, or the need for education should not be the sole reasons for removing a child from their family and placing them in alternative care. Such removal should be a temporary measure and considered only as a last resort, with close monitoring.

Siblings should remain together during the removal and placement process, unless it is unsafe or not in their best interests. Alternative care placements may be initiated by the child, their parents, or other primary caregivers, such as grandparents or other relatives.

To support these efforts, the Cabinet Secretary responsible for finance established the Child Welfare Fund under the Public Finance Management Act (2012) (Cap. 412A). This fund will facilitate the realization of the rights guaranteed by Article 43(3) of the Constitution by covering reasonable expenses related to alternative care and other social security programs aimed at ensuring the child's welfare.

Read more blog posts here! https://wjmaxwell.co.ke/blog/0/0

Disclaimer: This is not legal advice and should not be relied upon as such.

Contact us for further details.

Email info@wjmaxwell.co.ke || or call/text/WhatsApp 0733 61 09 61

W.J. Maxwell & Associates Advocates

Leaders in Law: Reshaping the Practice of Law

It is guided by Section 137 A-0 of the Criminal Procedure Code and Criminal Procedure (Plea Bargaining) Rules, 2018.

A plea agreement is an agreement entered into between the prosecutor and an accused person where —

(a) an accused person has been charged in court; and

(b) at any time before the court passes judgment.

A plea bargain heavily relies upon the accused person pleading guilty to the charges. It might be some of the charges or all charges. Accused are always advised by their lawyers to accept the terms of the plea bargain if it is seen as beneficial to them.

For the two sides to reach an agreement, both the Prosecutor and the Accused must see a benefit in the plea bargain: prosecutors seek a guilty plea and an efficient case resolution, while the Accused is motivated to plead guilty to receive a reduced or commuted sentence.

However, the intention and execution of plea bargains often diverge. Critics argue that plea bargains can lead to coerced guilty pleas and may also conceal corrupt or unlawful behaviour by prosecutors.

A Plea Bargain is, however, viewed as a necessary tool in dispensing justice. It saves the judicial time and the expense of a lengthy trial. Without plea bargains, there simply would not be enough time for judicial officers to oversee all the cases.

How to handle information obtained from an accused person

The information obtained from an accused person during the course of plea negotiations shall not be used against him or her during the prosecution of the case if the plea negotiations ultimately fail. The information is regarded to have been taken on a without-prejudice basis.

However, if the negotiations fail due to the actions or omissions of the accused, this information might be used in their prosecution.

Initiation of plea negotiations

Plea negotiations may be initiated by a prosecutor, the accused person or the accused's lawyer.

Consultations by the Prosecutor

Before entering into a plea agreement with an accused person, the prosecutor must—

(a) Consult with the investigating officer of the case;

(b) Consider the nature and the circumstances relating to the case, the personal circumstances of the accused, the interests of the community; and

(c) If possible, allow the victim or the victim's lawyer an opportunity to make a representation to the prosecutor regarding the terms of the agreement.

Ultimately, the prosecutor has the sole discretion to decide whether to enter into a plea agreement or not.

Including Victim Compensation

A plea agreement may include a clause for the payment of compensation to a victim by an accused person.

Where a plea agreement includes a clause for compensation payable to the victim by an accused person, the value or form of compensation shall be as agreed to after negotiations between the victim and the accused person and endorsed by the prosecutor if, in his or her opinion, the compensation serves the ends of justice.

A proposal to include the payment of compensation to the victim in a plea agreement or any negotiation for compensation payable to the victim may be made or initiated by the accused person or the victim.

Where negotiations for compensation payable to the victim break down or the prosecutor determines that the proposed compensation defeats the ends of justice, the prosecutor shall not include the proposal for compensation in the final draft of the plea agreement.

Presenting the Plea Agreement to Court

The prosecutor must present the factual basis of the plea agreement in court. This includes detailing all case circumstances and any mitigating factors favouring the accused when they plead guilty according to the agreement's terms.

Sentencing recommendations

A prosecutor and the accused person or the accused lawyer can each make a specific recommendation to the court as to the sentence to be imposed and include the recommendation in the final plea agreement.

Notwithstanding the recommendation of the parties, the court retains the sole discretion in sentencing.

If the prosecutor recommends a harsher sentence than that in the plea agreement, the accused can withdraw their guilty plea and the plea agreement.

If the court recommends a lighter sentence, the accused cannot withdraw their guilty plea based on this alone, but the prosecutor can propose an appropriate sentence.

Finalisation of agreement

A plea agreement shall be finalised when the prosecutor and the accused person sign the agreement.

Where applicable, the legal representative shall also sign the plea agreement.

Where the plea agreement includes a compensation clause, the complainant shall sign the compensation clause of the agreement.

In the end, the Accused;

1. Waives the right to full trial.

2. Pleads guilty.

3. Is ready for convictions and will receive some form of punishment (imprisonment, fine, probation, community service, compensation, restitution, apology, supervision).

4. Waives the right to appeal.

5. MUST uphold his or her end of the deal, such as cooperating in the investigation of another offence, or testifying against a co-accused or the plea bargain may be revoked.

Read more here! https://wjmaxwell.co.ke/blog/0/0

Disclaimer: This is not legal advice and should not be relied upon as such.

Contact us for further details.

W.J. Maxwell & Associates Advocates

email info@wjmaxwell.co.ke || or call/text/WhatsApp 0733 61 09 61

The real reason why the Small Claims Court was created was to streamline business operations in Kenya for Businesses and Companies as opposed to settling disputes between individuals. It was meant to be an accessible forum for resolving financial disputes quickly and efficiently for businesses. This legal mechanism was envisioned as a commercial vehicle to aid businesses and companies in settling their disputes in a swift manner and allowing them to return to their primary operations without prolonged legal distractions. While the Small Claims Court is accessible to both individuals and businesses, it is apparent that the system is inherently more beneficial to businesses, particularly during the execution stage after judgment.

Commercial Vehicles for Business Efficiency

Small Claims Courts serve as crucial commercial vehicles for various business entities, including large corporations like banks and hospitals, as well as medium and small enterprises such as microfinance institutions, wholesalers, hardware stores, and even small retail shops and grocery stores. The design of these courts aims to facilitate quicker resolutions, helping businesses to minimize downtime and maintain operational continuity. However, despite the court’s accessibility to individuals, businesses are better equipped to utilize these courts effectively, especially during the post-judgment phase.

The Execution Stage: A Critical Challenge

Securing a favourable judgment in court is often only half the battle in litigation. The real challenge lies in executing that judgment to satisfy the decretal amount (amount awarded during judgment)—ensuring that the judgment debtor actually pays the sums awarded. This stage is fraught with difficulties and complexities, particularly when the debtor is an individual.

Why Businesses Have an Edge over Individuals

There are several reasons why it is generally easier for businesses to satisfy decretal amounts awarded in judgments compared to individuals:

Businesses typically have tangible, traceable assets that are easier to identify and seize. For instance, a company might own inventory, equipment, real estate, or other valuable assets that can be attached and sold by the auctioneers to satisfy the judgment. In contrast, individuals may not possess significant assets, or their assets may be less visible and harder to locate.

Businesses operate from known, fixed locations, making it easier for decree holders to locate and attach movable properties. This is in stark contrast to individuals who might not have a permanent address, complicating the process of locating and seizing their assets. You have to know where they stay before you can call in auctioneers on them. The costs associated with locating them can be more than what was awarded to you in court.

Business bank accounts are often publicly known and can be garnished to satisfy a judgment. This transparency makes it easier to access funds directly from the business’s financial accounts. Individuals, however, may have multiple accounts, some of which may be hidden or difficult to trace, further complicating garnishment efforts.

The court can order attachment of the judgment debtor’s accounts, and the sums found in the account be deducted automatically to satisfy the decretal amount. The catch is that you must first identify the account numbers and plead directly with the court to give an order to garnish the account. You can’t simply state that the Judgment Debtor has an account with Equity Bank.

Businesses operate on structured budgets and business models, which can facilitate the settlement of decretal amounts. A business might have contingency funds, insurance, or other financial mechanisms in place to handle such liabilities. On the other hand, individuals typically rely on salaries or wages, which may not be sufficient to cover large judgments, and they lack the financial flexibility that businesses enjoy. Yes, you can garnish an individual's salary to satisfy the decretal award, but the amount is limited to a lower percentage of their net income, of course, the court will factor in the basic needs of the family before deciding on a proper cut.

Other Challenges in Executing Judgments Against Individuals

Executing judgments against individuals presents numerous challenges that do not typically affect businesses:

- Asset Concealment.

Individuals can more easily hide or transfer assets to evade judgment enforcement. They might use tactics such as transferring ownership to family members or moving funds to untraceable accounts.

- Legal Protections:

Individuals benefit from various legal protections and exemptions that shield their assets. For instance, a party can invoke homestead exemptions that protect a person's primary residence from being seized to satisfy a judgment. He might argue that the household items belong to his wife.

- Personal Bankruptcy:

Individuals can declare bankruptcy, which can discharge many types of judgments or significantly reduce the amount recoverable by decree holders. This process provides a legal shield against complete asset seizure.

Conclusion

The Small Claims Court system, while theoretically designed to serve both individuals and businesses, inherently favours the businesses in the execution phase. When businesses fail to satisfy a judgment, the decree holder can often rely on a clearer and more structured path to asset seizure and liquidation. In contrast, pursuing an individual debtor can result in prolonged legal battles with little assurance of asset recovery, leading to dormant judgments that remain unfulfilled.

Businesses possess more traceable assets, operate from fixed locations, and have public bank accounts and structured financial models, all of which facilitate easier and quicker judgment enforcement. Conversely, individuals present numerous challenges, from asset concealment and legal protections to the possibility of bankruptcy, making the execution of judgments against them significantly more complex and less assured.

Disclaimer: This is not legal advice and should not be relied upon as such.

Contact us for further details.

W.J. Maxwell & Associates Advocates

email info@wjmaxwell.co.ke || or call/text/whatsapp 0733 61 09 61

W.J. MAXWELL & ASSOCIATES is a Law Firm established in 2022 and has rapidly positioned itself as a premier law firm in Kenya, renowned for delivering high-quality legal services. Our firm is distinguished by its market-leading expertise across a broad spectrum of legal areas, including Commercial, Corporate and Business Law, Banking and Finance, Capital Markets, Projects and Infrastructure, Power (Energy, Oil & Gas, and Mining), Mergers, Acquisitions and Private Equity Transactions, Employment and Employee Benefits, Tax, Real Estate, Conveyancing, Property and Construction Law, Succession and Probate Law, Non-profit Organizations, Commercial and Civil Dispute Resolution, Privacy and Data Protection Laws, Aviation and Space Law, Insurance Pension, and Criminal and Civil Litigation.

Our dynamic legal team is structured into three core departments:

1. Commercial and Corporate Law

2. Conveyancing and Property Law

3. Civil and Criminal Litigation

Each department is spearheaded by our experienced partners, who collaborate closely with a dedicated team of Associate Advocates, Legal Assistants, Paralegals, and Support Staff to ensure comprehensive and effective legal solutions for our clients.

We cater to a diverse clientele that spans various sectors of the economy, including individuals, private and public companies both domestically and internationally, local and international banks, financial agencies, pension administrators, and more. Our extensive experience and expertise have been honed through handling numerous complex legal instructions on behalf of our clients.

We support local and international investors in establishing, merging, and expanding their enterprises, leveraging our deep understanding of common law and relevant legislation in Kenya and abroad. Our services include incorporating companies for non-banking services, providing our clients with robust legal foundations for their business ventures.

With a commitment to excellence and a focus on client success, W.J. MAXWELL & ASSOCIATES is your trusted partner for navigating the legal landscape in Kenya and beyond.

Cianda House,1st floor,Room 111,Koinange Street, Nairobi

0733610961

info@wjmaxwell.co.ke